Meet Pinpoint

Our History

Pinpoint Federal Credit Union is a member-owned financial cooperative founded in Milton, Pennsylvania. Our story began in 1956 when a small group of teachers came together with a simple but powerful goal — to help one another achieve financial stability and make life better for their community. Originally known as Northumberland County Schools Federal Credit Union, our first “branch” operated out of a volunteer’s home. From those humble beginnings, the idea of people helping people became the foundation of everything we do.

What started as a credit union for local educators has grown into a financial partner for individuals, families, and businesses across our region. In 2017, we became Pinpoint Federal Credit Union — a name that reflects our commitment to meeting members exactly where they are in life and helping them move forward with confidence.

Today, we’re proud to serve a diverse and growing membership through our multi-common bond charter. That means we can welcome members through local businesses, organizations, and family connections — creating a stronger financial community built on shared ownership and trust.

At Pinpoint, every member is more than a customer. You’re a part-owner with a voice in shaping what we do and how we grow. Together, we’re redefining what it means to belong to a financial institution — one that’s focused on purpose, progress, and people.

If you’re not sure how you qualify for membership, we’d love to help you find your way in. Join the Pinpoint family — and see what it’s like to own where you bank.

Guiding Your Financial Journey

At Pinpoint, our story has always been about guidance, trust, and belonging. We’re here to be your financial GPS — helping you chart a path toward your goals, no matter where life takes you.

Just like the pinpoint on your map, we’re a steady guide through every turn. Whether you’re navigating the winding roads of unexpected challenges, cruising through life’s fast lanes, or enjoying the smooth stretches ahead, we’re here to help you stay on course. When obstacles appear, we don’t just reroute — we travel alongside you to find the best way forward.

As a member-owned credit union, our purpose is simple: to empower you to reach your destination with confidence. From your child’s first savings account to buying a home, building credit, or preparing for retirement, we’re committed to being your trusted partner for every milestone.

At Pinpoint, you don’t just bank here — you own it. And together, we’re creating a brighter financial future for our members, our families, and our community.

Meet Our Team

What Makes Pinpoint Unique? Our Dedication to You!

Brenda Raker, President & CEO; Cathy Koser, Service & Operations Champion; Jody Cutchall, Financial Services Specialist; Kaylei Klepper, Financial Services Member Champion; Angel Cuencas, Member Champion, Skyler Kitchen, Member Champion, Kinsey Metzger, Member Champion, Faith Shunk, Member Champion; and Jamie Smith, Community Engagement & Administrative Coordinator/Member Champion.

The board of directors and supervisory committee at Pinpoint are comprised of talented credit union members who volunteer to share their experience, time and knowledge in order to make Pinpoint a leader of financial services.

Jason Budman, Board Chairperson; Mark Shearer, Board Vice Chairperson; Norm Jones, Secretary & Treasurer; Cody Concini, Director; Catherine Kramm, Director, Shawn Moore, Director and Jeffrey Rearick, Membership Officer/Director

Supervisory Committee Members: Jeffrey Rearick, Committee Chair, Felicia Beaver and Seth Reitz.

As a Pinpoint member, you may run for our Board of Directors or volunteer your time on one of our Committees. If you are interested in more information, please contact Brenda Raker at the credit union. We would love for you to share your knowledge and experience to make Pinpoint a better financial cooperative for its members.

Member-Owned. Your Path Forward.

At Pinpoint, our members are at the heart of everything we do. Being member-owned means you have a voice in how we operate and a stake in our success. We empower you to take the wheel and navigate your own path forward, with the guidance of a financial partner that’s invested in your goals. Membership gives you access to low-cost or free services and periodic dividends — benefits that banks reserve for outside stockholders, not the people who actually own the institution.

Navigate with Convenience

Your financial journey shouldn’t be limited by location or hours. With access to over 5,000 shared branches and nearly 30,000 surcharge-free ATMs nationwide, Pinpoint ensures that no matter where life takes you, your path forward stays on course. You’ll enjoy the personal attention of a local credit union, paired with the convenience and reach of a large financial institution.

Guidance Through Every Turn

Every path forward is unique, and we’re here to walk it with you. By getting to know our members personally, we can help you plan for milestones, navigate challenges, and celebrate successes along the way. You’re not just an account holder — you’re part of the Pinpoint family. We host exclusive member events throughout the year to strengthen connections, and when you stop by, enjoy a cup of coffee, tea, or hot cocoa on us — and don’t forget a treat for your furry friend.

Bank Anytime, Anywhere

Life doesn’t always move on a schedule, and your banking shouldn’t either. With our secure, full-featured mobile app, you can check balances, make transfers between your accounts, send money to other members, move funds to and from other financial institutions, and deposit checks — all from anywhere, at any time. Our full electronic services also let you open accounts, make changes, enroll in new services, and sign loan or mortgage documents digitally. Pinpoint puts the power in your hands, so your path forward is always within reach.

Banking Made Simple. Your Path Forward Starts Here

At Pinpoint, we provide a full range of tools, services, and support designed to help you confidently navigate every stage of your financial journey. Whether you’re facing financial stress, rebuilding credit, or working to establish a stable routine, we’re here to help you take control of your money and move forward. From building savings and managing debt to accessing opportunities like loans and credit products, our goal is to help you replace uncertainty with confidence and create a path toward financial stability and independence.

We understand that money can feel overwhelming, but with practical tools, guidance, and support from Pinpoint, you can turn past challenges into opportunities — paying down debt, building savings, and accessing the financial products you need to move forward with confidence.

Pay & Receive: Stay on Course

-

Bill Pay: Keep your bills on track with one-time, scheduled, or recurring payments. Receive e-bills and notifications to stay ahead of deadlines.

-

Direct Deposit & Payroll Deduction: Let your income flow automatically to your accounts or loans, helping you save and manage your money efficiently. Now receive your deposit up to 5 days early — putting you further ahead on your path forward. Plus you will receive additional loan discounts when you are enrolled in direct deposit with auto pay.

Protect & Reward: Navigate with Confidence

-

Overdraft Protection & Courtesy Pay: Avoid unexpected detours with free transfers from your deposit accounts, or access Courtesy Pay for qualifying members.

-

Debit Card & UChoose Rewards: Use your debit card anywhere Visa is accepted and earn points redeemable for travel, electronics, entertainment, and more — rewards that keep you moving toward your goals.

-

Wire Transfers & Payment by Phone: Quickly and securely send funds when life calls for it, keeping your plans on track without missing a step.

Self-Service Options: Take Control of Your Journey

-

Online Forms: Easily access a variety of forms online to manage your accounts and services whenever it’s convenient for you.

Why Choose Pinpoint?

Being a member-owned credit union means your path forward is supported by benefits designed with you in mind:

-

Local ownership and decision-making

-

Accounts insured up to $250,000 by the NCUA

-

Competitive savings and investment rates

-

Low loan rates for vehicles, mortgages, personal, and debt consolidation

-

No-surcharge ATM access at 30,000+ locations nationwide

-

Youth education and savings programs

-

Low-rate Visa credit cards with rewards

-

Complimentary $1,000 Accidental Death & Dismemberment insurance through Trustage and $2,000 through American Income Life.

At Pinpoint, we’re more than a financial institution — we’re your guide, helping you plan, save, and move forward confidently at every stage of life.

Membership is Rewarding

Earn Rewards While You Save

Everyone loves saving, especially on the products and services you use every day. That’s what Love My Credit Union Rewards is all about. Through this program, Pinpoint members have already saved over $2 billion with discounts from trusted partners like TurboTax, H&R Block, Trust & Will, and many more.

Take advantage of these valuable savings to stretch your budget further, reduce stress, and put more toward your financial goals.

Start saving today — visit LoveMyCreditUnion.org to explore all the discounts and rewards available to you.

Your rewards are waiting!

Benefits That Move You Forward

At Pinpoint, being a not-for-profit financial institution means we put our members first. Instead of paying profits to stockholders, we return them to you through fee-free or low-cost services, competitive rates, and programs designed to help you reach your financial goals.

A Network That Works for You

As a financial cooperative, Pinpoint shares resources with other credit unions, giving you access to more shared branches and surcharge-free ATMs than most national banks. This network also allows us to offer up-to-date technology and convenient services, so you can manage your money confidently, wherever life takes you.

Personal Service That Understands You

We combine the capabilities of a large financial institution with the personal touch of a community partner. We know our members by name and offer tailored solutions to help you overcome credit challenges, rebuild financial stability, and access opportunities that other institutions may deny.

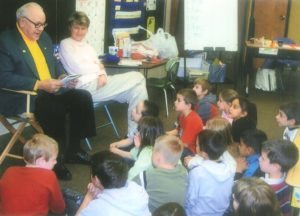

Education That Empowers

Financial knowledge is power, and our team is passionate about helping you use it. From first-time home buying to car buying, credit management, and identity theft prevention, we offer seminars and guidance to help you make informed decisions. Our youth programs, including “Saving with Mandy & Randy” and “Making the Right Money Moves”, plus initiatives like our annual “Pack the Sack” school supply drive, reflect our commitment to building a financially confident, educated, and empowered community. At Pinpoint, we’re proud to guide members of all ages toward a brighter financial future.